Artificial Intelligence in Finance: in 2024 will look very different thanks to AI. Explore 3 AI tools that help analysts improve forecasting, analysis, and reporting. Key topics include AI for financial analysis and predictive analytics.

Welcome, fellow financial enthusiasts! 📈 Are you ready to dive into the wild world of AI tools that’ll turbocharge your analytical prowess? Buckle up, because we’re about to unravel the secrets of financial success using futuristic algorithms, neural networks, and a dash of unicorn magic. 🦄✨

In this blog post, we’ll explore the Artificial Intelligence in Finance, AI tools that’ll make your spreadsheets sing, your charts dance, and your ROI do the moonwalk. By the end of this rollercoaster ride, you’ll be armed with knowledge that’ll make Warren Buffett raise an eyebrow and Elon Musk tweet about it (okay, maybe not, but close). So grab your calculators, adjust your pocket protectors, and let’s embark on this financial odyssey!

1. Macroaxis: Optimizing Portfolios with AI

Overview:

Macroaxis: Revolutionizing Portfolio Management with AI positions itself as a state-of-the-art platform tailored to the discerning needs of active investors and financial professionals alike.

It boasts an arsenal of cutting-edge portfolio optimization tools, fueled by the prowess of artificial intelligence (AI), assuring users the capability to craft portfolios finely tuned to their unique risk appetites and financial aspirations. Beyond mere optimization,

the platform grants access to a rich spectrum of economic indicators, leveraging AI algorithms to unearth promising investment avenues. By melding sophisticated analytics with AI-generated insights, Macroaxis aspires to arm users with the acumen necessary for navigating the ever-shifting tides of the market landscape.

Pricing:

Macroaxis adopts a bespoke pricing model, opting against public divulgence of specific plans and costs. Prospective users are urged to engage with the platform’s sales team for tailored pricing information aligned with their specific needs. While this tailored approach facilitates adaptability to a diverse array of user requirements, the lack of transparent pricing may pose a barrier for individuals seeking upfront clarity regarding costs.

Performance:

Reviews of Macroaxis: Revolutionizing Portfolio Management with AI laud its formidable analytical arsenal and user-friendly interface. Users extol its capacity to furnish insights akin to those wielded by seasoned financial experts, underscoring the platform’s efficacy in facilitating well-informed investment decisions. Nevertheless, some users voice reservations regarding the platform’s interface, citing instances of perceived complexity and advocating for smoother navigation. Despite these challenges, Macroaxis’s steadfast performance in furnishing actionable insights and optimizing portfolios remains a salient feature of its offering.

Value for Money:

Evaluating the value proposition of Macroaxis: Revolutionizing Portfolio Management with AI hinges upon individual user experiences and requisites. While the platform’s advanced functionalities and AI-infused capabilities may justify its cost for certain users, the opacity surrounding pricing complicates objective assessments of value for money. Reviews indicate a middling rating for the platform’s value proposition, implying that its suitability may hinge on users’ subjective assessment of the utility of its features vis-à-vis associated costs. Nonetheless, the provision of a complimentary trial period empowers potential users to gauge the platform’s suitability and value proposition prior to commitment, thereby mitigating potential financial risks associated with adoption.

Macroaxis: Revolutionizing Portfolio Management with AI presents a compelling proposition for active investors and financial professionals in search of sophisticated portfolio optimization solutions augmented by AI-driven insights. While its performance and value for money earn commendation, the opaque nature of its pricing underscores the imperative of thorough evaluation to ascertain its compatibility with individual investment strategies and fiscal constraints.

2. Telescope AI: Predicting Market Trends

Overview:

Telescope AI emerges as a groundbreaking platform engineered to forecast market trends through advanced artificial intelligence algorithms. Crafted by a synergy of data scientists and finance mavens, this tool endeavors to furnish invaluable insights into diverse financial arenas encompassing stocks, commodities, and currencies.

By scrutinizing extensive historical data sets and harnessing machine learning techniques, Telescope AI endeavors to prognosticate future market movements with exceptional precision.

Key Features:

Advanced Machine Learning Algorithms:

Telescope AI harnesses state-of-the-art machine learning algorithms to sift through historical market data and pinpoint patterns indicative of potential future trends. These algorithms continuously refine their predictive capabilities, adapting seamlessly to evolving market dynamics and thereby enhancing the accuracy of forecasts over time.

Comprehensive Multi-Market Analysis:

Diverging from conventional market analysis tools fixated on singular markets, Telescope AI offers simultaneous analysis across multiple financial domains. This holistic approach affords users a panoramic view, enabling astute decision-making informed by a broader perspective.

Real-time Updates:

The platform furnishes real-time updates on market trends, ensuring users have access to the most current information for timely investment decisions. This functionality proves invaluable in high-speed markets where split-second decisions can yield substantial impacts.

Customizable Alerts:

Users enjoy the liberty to tailor alerts to their specific preferences and investment strategies. Whether opting for alerts pertaining to significant market shifts, specific assets, or predefined trading signals, Telescope AI accommodates varied alert settings, fostering flexibility.

Intuitive User Interface:

Telescope AI prides itself on an intuitive and user-friendly interface catering to both novices and seasoned investors alike. Presenting intricate market data in a visually captivating manner, the platform employs interactive charts and graphs to facilitate effortless analysis.

Value for Money:

Telescope AI emerges as a prudent investment proposition owing to its advanced functionalities, prowess in predicting market trends, and user-centric interface. While initial subscription costs may be incurred, the potential for augmenting investment returns through informed decision-making substantially outweighs these expenses. Furthermore, real-time updates and customizable alerts empower users to seize market opportunities expediently, rendering Telescope AI a lucrative investment avenue for individuals and institutions alike.

Telescope AI emerges as an indispensable and efficient tool for forecasting market trends, offering an array of features engineered to equip investors with actionable insights. Whether traversing the corridors of seasoned trading or venturing into the financial realm anew, Telescope AI emerges as an invaluable asset for navigating the intricate labyrinth of financial markets and making well-informed investment decisions.

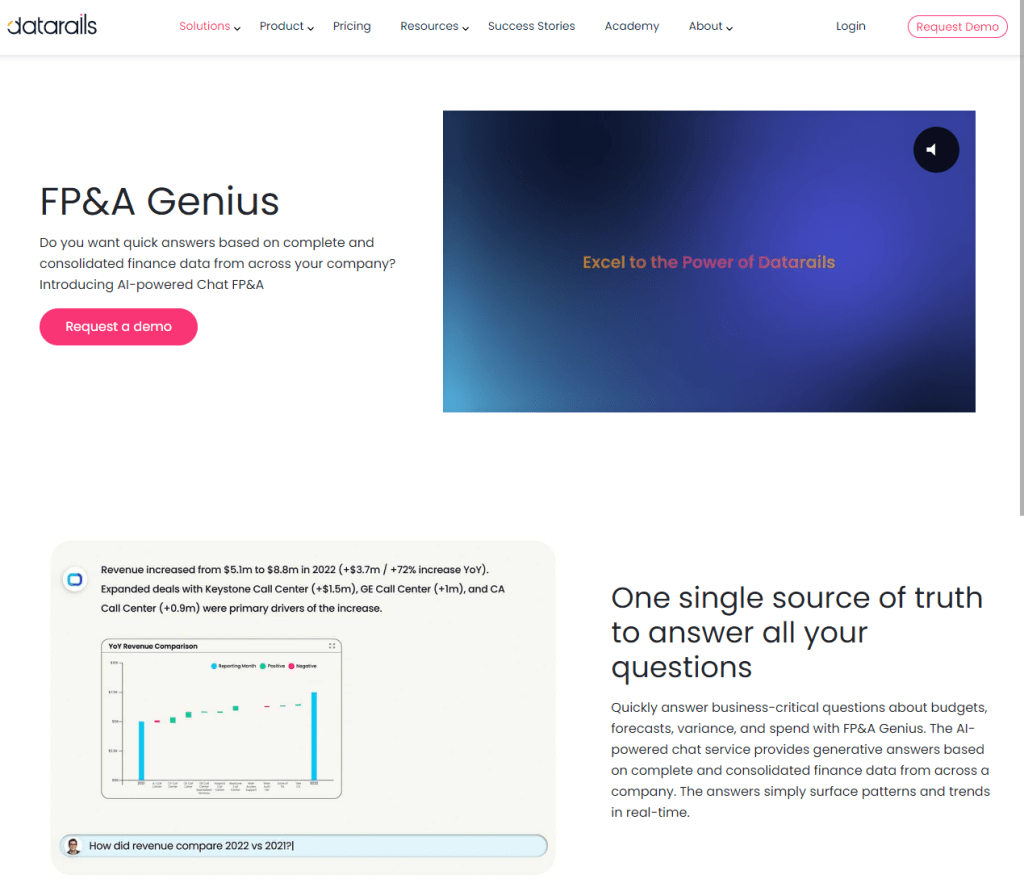

3. Datarails FP&A Genius: Streamlining Financial Analysis

Insight into Datarails FP&A Genius

In the realm of financial planning and analysis (FP&A), Datarails FP&A Genius emerges as a formidable tool tailored explicitly to meet the needs of FP&A professionals. It serves as a centralized hub for the meticulous management and thorough analysis of financial data, simplifying intricate workflows, and empowering astute decision-making.

Unveiling Key Capabilities

At the heart of Datarails FP&A Genius lies its expansive array of capabilities, setting it apart from the crowd. From the consolidation and standardization of data to the execution of sophisticated forecasting and scenario modeling, it presents a comprehensive toolkit essential for propelling business performance and shaping strategic initiatives.

Revolutionizing Data Analysis

Datarails FP&A Genius harnesses the power of advanced algorithms and machine learning to revolutionize data analysis processes. By automating tedious tasks and minimizing the risk of human error, it accelerates the generation of actionable insights, enabling users to navigate decisions grounded in data with unwavering confidence.

Empowering FP&A Professionals

Datarails FP&A Genius stands as a transformative force in the FP&A landscape, seamlessly blending cutting-edge technology with intuitive design. With its robust feature set and automated functionalities, it empowers organizations to harness the full potential of their financial data, driving sustained growth and fostering a culture of informed decision-making.

Other Notable AI Tools

Beyond the highlighted tools, consider exploring these additional options:

- UPDF

- Domo

- Brooke.AI

- Stampli

- Nanonets

- Planful Predict

- Trullion

- Vena Insights

- Polymer

Comparison of Artificial Intelligence in Finance

Each tool has its strengths and weaknesses. Consider the following factors when choosing the right fit:

- Company Size: Some tools cater better to small businesses, while others are designed for large corporations.

- Integration: Evaluate how well the tool integrates with your existing systems.

- Cost: Compare pricing models and choose based on your budget.

Conclusion:

In today’s ever-evolving financial arena, AI tools have transitioned from being mere options to indispensable assets. Whether you’re fine-tuning portfolios, forecasting market trends, or streamlining data analysis, these tools serve as catalysts, empowering financial analysts to excel in the digital era.